Digital Core Reit

Global X Data Center REITs and Digital Infrastructure ETF 771 Top Redemptions. Digital Core REIT DC REIT is the second pure play data centre REIT that is planning to list in Singapore.

The REIT had its fair share of trouble due to its overexposure to Alberta.

. As Digital Core REITs final IPO prospectus is not out yet some details are not available. Home REIT posts admirable performance in maiden annual results By Ifeoluwa Taiwo 2021-11-11T085100 Home REIT posted a strong financial performance for its first year following its IPO on the main market of the London Stock Exchange in October 2020. Digital Realty Trust Inc DLR.

Here is a brief overview of the indicative offering details from DC REIT preliminary prospectus. Read the Digital Editions. Should DR choose not to co-invest the new Core REIT can invest alone or in partnership with third parties.

4 Buy Raffles Medical Group on current share price weakness. Digital Core REIT will be the exclusive S-REIT vehicle sponsored by Digital Realty. At its indicative IPO price of US088 Digital Core REITs distribution yield is estimated to be 475 for the year ending 31 December 2022.

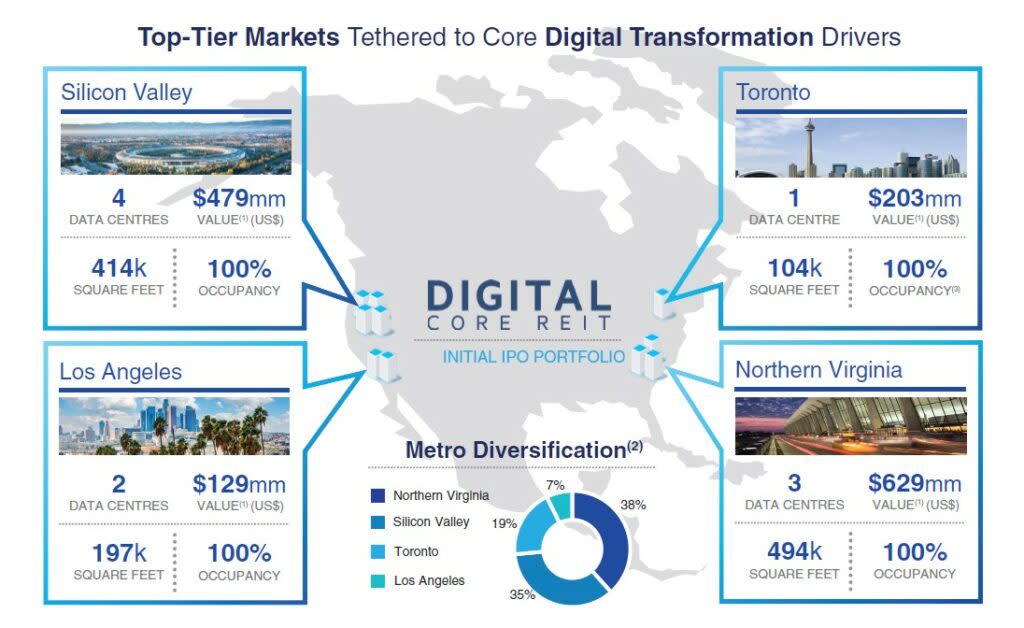

It will have an initial portfolio of 10 freehold data centres in US and Canada with an appraised value of US14 billion. Spoilers alert Digital Core REIT comes with. Meanwhile UOB Kay Hian Pte Ltd analyst Yap Xiu Li wrote in a note on Wednesday that IGB REITs 3QFY21 results were slightly below UOB Kay Hians expectations due to IGB REITs higher-than-expected expenses.

Zacks free daily newsletter Profit from the Pros provides 1 Rank Strong Buy stocks etfs and more to research for your financial portfolio. CorePoint Lodging is a hospitality REIT based in Irving that is focused on select-service hotels that was spun off from La Quinta Holdings Inc. IShares Core US REIT ETF.

Five years ago Albertas markets came crashing down as the oil prices fell. D-Reit is a project that arises in response to the need to contribute a value proposition to the world of decentralized finance DEFI through the opening of new tangible investment opportunities aimed at any user who wishes to be part of this economic environment. Digital Core REIT is expected to have a gearing ratio of around 27 below its listed peers in Singapore.

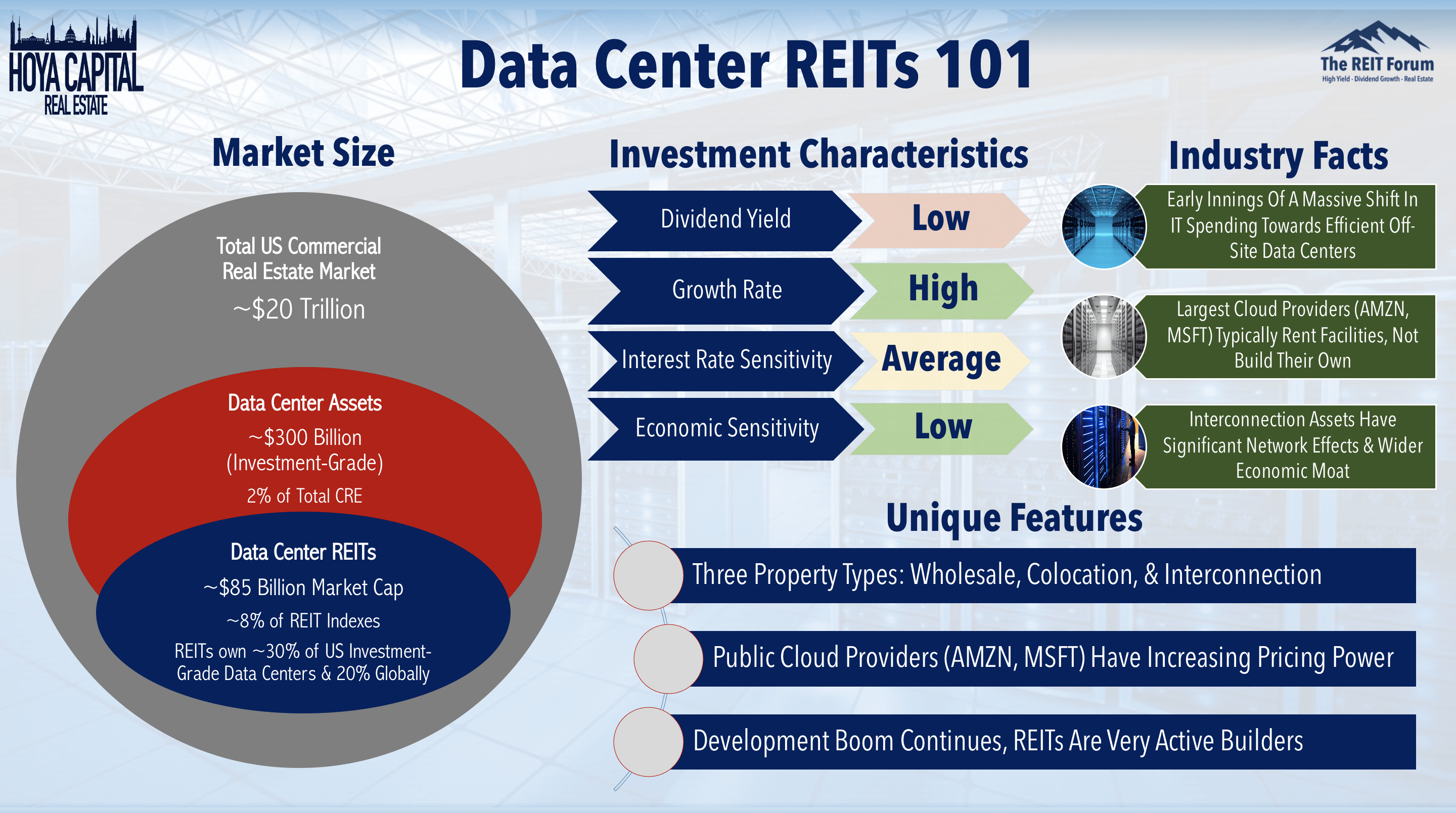

Investors await corporate action to boost Chinese S-REITs. Forecast distribution yield for 2022 is 475. Mapletree Industrial REIT technically is an industrial REIT but currently 50 of its assets are in data centres with a large proportion in North America.

Vividthree raises 22 million via placement with sights on NFT market. According to the preliminary prospectus the manager intends to raise gross proceeds of approximately US977 million from the offering including the issuance. Comparing Digital Core REIT against Singapore Data Centre Operators.

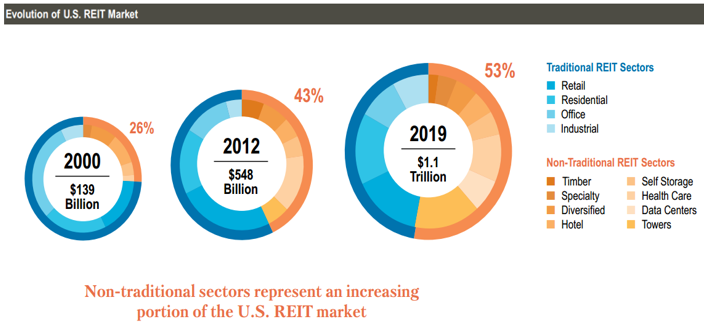

Retirement savers should look for broad-based funds as core holdings and consider the fees. REIT ETFs hold exclusively real estate investments trusts REITs. Digital Core REIT is a Singapore REIT S-REIT established with the principal investment strategy of investing directly or indirectly in a diversified portfolio of stabilised income-producing real estate assets located globally which are used primarily for data centre purposes as well as assets necessary to support the digital economy.

The Real Estate Investment Trust REIT which owns 10 freehold data centres in the United States and Canada worth around 14 billion is issuing 682. This REITs sponsor is Digital Realty a leading data centre developer and operator. Here is a brief overview of the indicative offering details from DC REIT preliminary prospectus.

Okay here are some more of my notes. Digital Core REIT DC REIT is the second pure play data centre REIT that is planning to list in Singapore. The closest local competitor to Digital Core REIT is Keppel DC REIT and Mapletree Industrial REIT.

DLR decide to list a portfolio of 10 data centres in Singapore as Digital Core REIT. IPO Price will be US088 Forecast distribution yield for 2022 is 475 There will be 267m units on offer in total. REIT ETF 264 BBRE.

The 20 year triple-net lease is structured to provide straight-line annual rent of approximately 5100000 which represents an unleveraged. We project robust core EPSDPU dividend per unit growth of 21 year-on-year in FY22F in line with retail sector recovery he said. Cue VPN a REIT ETF that seeks to invest in companies that operate data center REITs and other digital infrastructure supporting the growth of communication networks according to Global X.

Since then Boardwalk has diversified its portfolio disposed of its non-core assets and diversified its overall holdings to build a more reliable reputation in the industry. Digital Core REIT is expected to have an aggregate leverage of 27 per cent as at the listing date -significantly lower than its peers - giving it a debt headroom of up to US596 million. Digital Core REIT files IPO adding to year end listing jump.

1 day agoDigital Core REIT sponsored by US-listed Digital Realty Trust is set to raise 600 million in an initial public offering IPO in Singapore the largest listing in the city-state this year the company said in its prospectus on Monday. 1 day agoDigital Core REIT sponsored by US-listed Digital Realty Trust is set to raise 600 million in an initial public offering IPO in Singapore the largest listing in the city-state this year. There will be 267m units on offer in total.

Schroder REIT posts 9 increase in NAV By Riya Makwana 2021-11-24T142800 Schroder Real Estate Investment Trust SREIT has announced a 9 increase in NAV to 3234m in its interim results for the six months to 30 September 2021 compared to 2968m on 31 March 2021. IPO Price will be US088. Core REIT will also be offered the global right of first refusal for a number of properties.

Going forward Digital Realty said it intends to co-invest with Digital Core REIT for all future acquisitions taking 10 percent of each asset. Rock solid sponsorHot asset class data centresGood valuations both yield and PriceBookTriple net lease with built in rental escalationsBlue chip tenants with 100 occupancyLow gearing 27 And a list of cornerstone investors that reads like the whos who in fund management. 475 Yielding Digital Core REIT is a Premium REIT IPO.

SINGAPORE - Data centre real estate investment trust Reit Digital Core Reit is raising close to US1 billion S137 billion in a Singapore initial public offering IPO of 267 million units. - US-listed global data centre behemoth Digital Realty NYSE.

Cute Bear Designed By Holl 87 You Need A Logo Just Tap The Link In Bio Logotoons Logo Illustrations B Kids Logo Design Bear Cartoon Character Design

Tax Excellence Team Workshop On Immovable Property Today Future Etc For More Detail Call Now At 02134329108 0323322925 Workshop Projects To Try Reit

Druva Crosses 100 Million In Annual Recurring Revenue Cloud Data Data Protection Digital Transformation

12 Days Of Christmas In The Classroom Is An Engaging And Educational Way To Count Down To Christmas Bre Christmas Teaching Christmas School Christmas Classroom

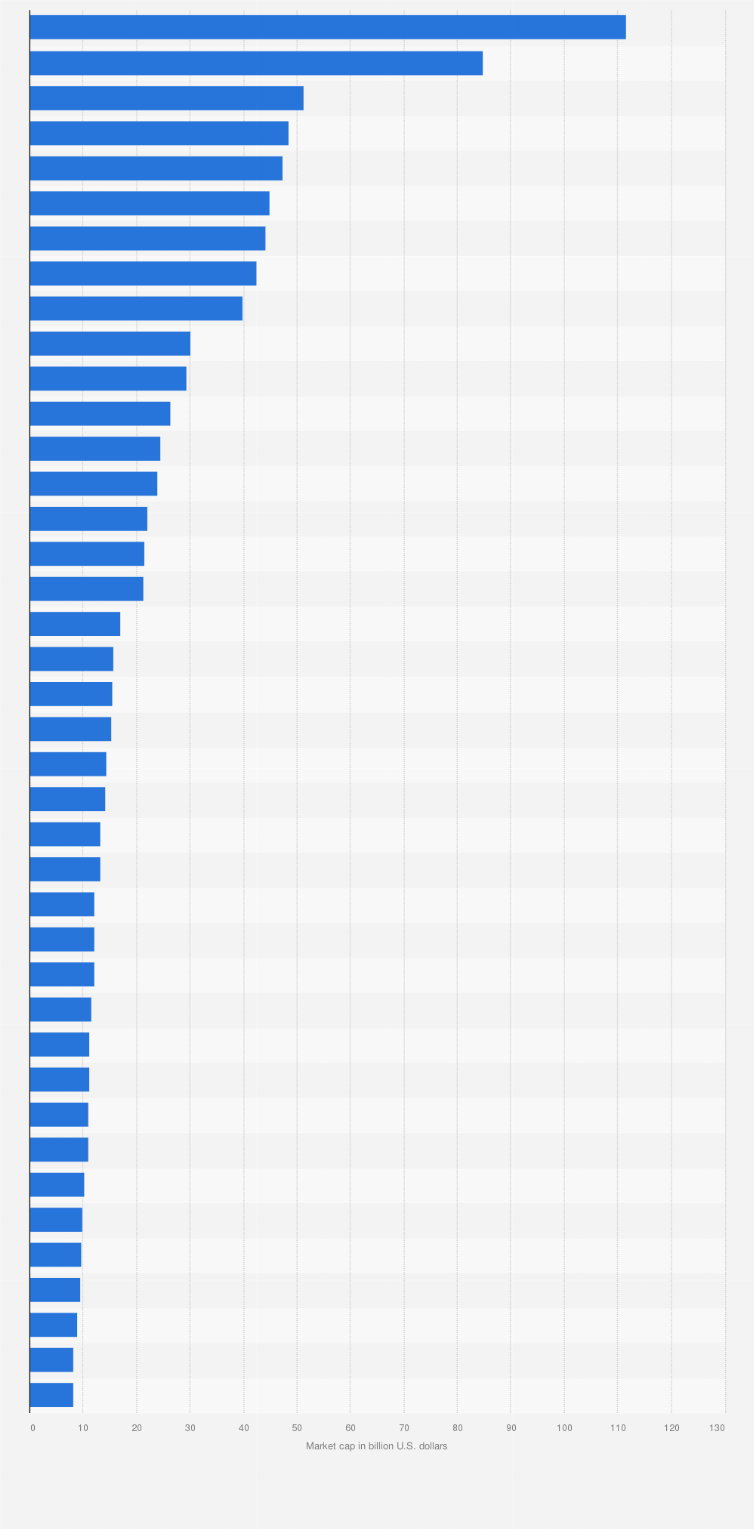

Largest Global Reit By Market Cap 2020 Statista

Ecs1601 Assignment 3 2014 Answers In 2021 Assignments Life Review Academic Writing

/cloudfront-us-east-2.images.arcpublishing.com/reuters/GYQ2QP4Z6NJ4JCY3ASJLYSGGVQ.png)